Investing in the right equipment vendor can unlock your network deployment

By Nikolaj Sobolev, Customer Solution Manager

(3-minute read / 630 words)

When building a new full fibre network, builders and operators rightly look to maximise the experience for their customers while removing any unnecessary costs.

Because it is such a small part of the overall cost of building a new network, some companies may think about sourcing cheaper operator equipment – known in the industry as Optical Line Terminal (OLT) technology – but this is a mistake.

Simply focusing on cutting down costs regardless of the consequences is a short-sighted view. When deploying a fibre network, political, geographical and logistical challenges are commonplace. Ignoring these risks, almost always leads to additional costs.

OLT savings do not always mean success

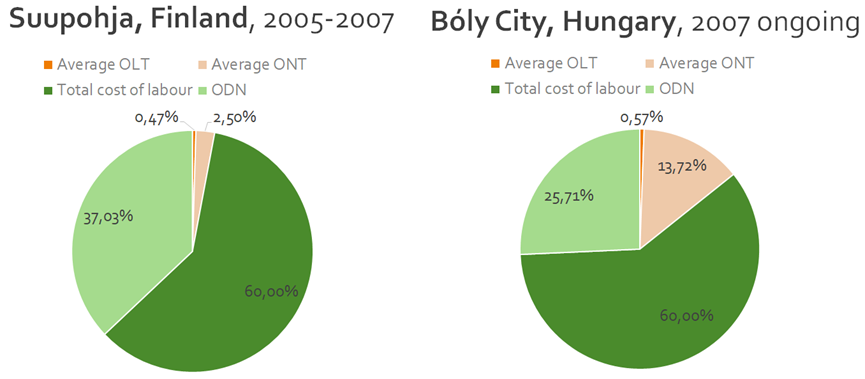

For working out the potential expenditure for PON projects, we must separate costs between OLTs, Optical Network Terminals (ONTs), Optical Distribution Network (ODN) equipment and labour necessary for trenching and laying optical cables. On average, the cost of providing OLTs in FTTH network builds amounts to only about 1% of the total build cost. An OLT is the operator’s equipment that connects with end-user devices, such as routers or home gateways. Other parts of the network require more expenditure than operator equipment, including this end-user equipment and the ODN. The ODN is typically an expensive outlay as it is used for data transmission and is responsible for the performance and reliability of the system. By comparison, the labour cost of digging or laying fibre is estimated to be on average 60% of the total cost of a project.

When we look at several PON projects that have taken place, one example we can draw on is from the early days of GPON technology in Suupohja, Finland, from 2005 to 2007. This was a greenfield deployment in very rural location. The total investment surpassed 10 million Euros and the project aimed to see 5,000 homes passed with fibre. By estimating that it was 2,000 Euros per user, the price could be estimated to establish the OLT price per user. For this example, the average spend on OLT was just 0.47%.

Another example is an ongoing project in Bóly City, Hungary. It covers both rural and urban areas across 14 towns with a total population of around 12,000 people. The total number of subscribers has reached 1,458 institutions and companies, and the project has connected 99.5% of all premises. In this case, the OLT cost was just 0.57%.

These examples lead us to conclude that the average OLT cost for each PON network is below an estimated 1%. This means that the price difference between competing vendors offering OLT is only a tiny fraction of the overall spend on the project. If companies were to select a cheaper vendor, it might see savings of around 0.01-0.05% per project, but the risks and potential downsides in terms of customer experience alone make this an uneconomic and potentially perverse saving. Choosing the wrong equipment provider can also create risks including; reduced support, risk of an unexpected political situation, a lack of availability of products, equipment delivery delays, and a lack of flexibility to migrate a network.

The potential financial gain must be weighed against the associated risks.

So, what now?

It is critical the vendor, that companies are partnered with, can mitigate these issues. My general advice would be to introduce a multi-vendor approach and use vendors from the same geographical region. Of course, you may pay slightly more, but thanks to having this local support, logistical and supply chain issues are quashed. Companies must carefully and diligently select an equipment vendor that supplies the quality solutions and support that lets them unlock the full potential of their networks.

Watch the complete recording of the webinar here: The Phenomenon of 1% Investment in CO Equipment.

Related articles

Kontron's Take on the UK&I Market

Learn more

Unlocking invaluable benefits for fibre rollouts with interoperability

Learn more

Maintaining CPE Sustainability Every Step of the Way

Learn more