ZX-GS PON: Should I stay or should I go?

by Matjaž Pogačnik, Strategy Consultant, Iskratel

Remember the good old days and the ZX-Spectrum-vs-PC dilemma? As oversimplified as it may seem, the dilemma about when to transition to XGS-PON has all the same ingredients.

Where it all started

As a kid, I was a huge fan of Sinclair ZX Spectrum 48K in the eighties. My mom usually pointed out that I played games far too much, but on the other hand, while brutally enjoying it, I became familiar with English, and learned programming in Basic and C.

Later on, 386-based PCs appeared. They were far too expensive for me at the beginning. After some time, when prices began to diminish almost on weekly basis, and the specs kept improving, the main question was when to purchase a PC. We were growing up, and the games were not the main focus anymore. While more and more kids on the block bought one for themselves, the object of my desire eventually came to our house when my father bought one for his business. After getting acquainted, all I could say was I was sorry it took me so long to take the leap of faith. This was no longer a gaming machine; you could do important things with it: my father used it to run his business.

The dilemma

Nowadays, one of the most discussed questions with operators is when to start deploying XGS-PON. I often reminisce the good old days of the ZX-Spectrum-and-its-derivates-vs-PC dilemma. A huge oversimplification, of course – but don’t we have the same ingredients for the dilemma? Prices, specs, other kids, use cases? The difference is just that “games” became serious business and that “other kids on the block” turned into fierce competitors on the market.

Some find it easy

Some operators seem to be firmly decided that XGS-PON is the only way to proceed to the bright future. We often see this with newcomers to the market – wishing to differentiate with speed – and with open-access (OAN) players in suburban and rural areas. Their business cases usually break-even after a relatively long time compared to urban deployments, with household density being one of the main factors. In effect, they are forced to make long-term decisions on the deployment ingredients (active equipment being one of them). This is often combined with the fact that they have a relatively small technical team, and consequently prefer having a future-proof solution that will not require costly and time-consuming upgrades. In addition, they usually do not have to cope with legacy networks, and thus have the privilege of focusing on the end goal: a local FTTH monopoly. All in all, their decision-making process is fairly simple compared to incumbents or cable operators.

Business case. Can you do it right?

The best way to approach the dilemma is to analyse the business case, and it is the homework that every operator needs to do for themselves. The business case of FTTH deployment may be quite complex. One has to take into account various interdependent factors over the entire lifespan or a period of interest, such as CAPEX for implementation; OPEX (TCO approach); expected take-up ratio; possibilities for additional revenues; presence of competition and their anticipated activities; possible cooperation with local communities; expected growth of market share; maximum reuse of existing infrastructure (utilities and public infrastructure); mobile coverage; FWA (fixed wireless access) plans and 5G FWA in particular, etc. If legacy infrastructure is in place already, one should not forget other costs that might occur in parallel, such as those related to the number of failures and maintenance costs, reduction possibilities, replacement of or total switch-off of legacy networks in newly built FTTH areas – to name only a few.

The decision for OLT may look straightforward…

In the FTTH network, the OLT (optical line termination – the active equipment at the central office) makes “just” a small portion of the overall investment. Being distributed among many end-users, one might consider it less relevant, which is also the reason some operators tend to look at it as a clear decision for a more future-proof XGS-PON solution. The combo solution with simultaneous use of GPON and XGS-PON also supplies operators with ultimate technology and the flexibility to control costs with “pay as you grow”.

…but mind the CPE, please

On the other hand, the CPE (customer-premises equipment) influences the business case far more than costs shared among many end-users. An XGS-PON ONT (optical network termination) is still more expensive than a GPON ONT, and this puts operators in doubts whether to wait for prices of XGS-PON CPE to fall.

I believe that the best approach is to consider for how long the CPE is going to stay in the customer’s home. We need to observe CPE costs during a longer period and take into account the replacement costs as well, not forgetting the contribution of “truck roll” visits of technicians to the customers.

Split the problem

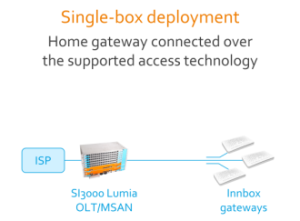

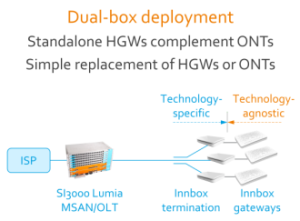

Like mathematicians, we need to split the CPE into two components, the ONT and the HGW (home gateway, with Wi-Fi), and address their costs separately. Stemming out from our many years of P2P (point-to-point), GPON and XGS-PON FTTH experience, we can say that the ONT side is going to be at customer premises for at least 10 years – probably even longer since XGS-PON provides sufficient capacity for a longer period of time.

In contrast, the HGW with Wi-Fi is going to be replaced more often. The main reason are huge changes in the importance of customers’ home networks that have occurred because of the pandemic over the last two years. The main changes are the way users connect (Wi-Fi has become the king of the home), where they connect (good coverage in every corner of the house is a must), use cases (work vs leisure – also connected to quality and reliability of connection), growth of users at home (people and devices) and their mobility. With the rapid evolution of Wi-Fi standards and devices, wireless access points have become ultimately “responsible” for end-user’s experience of service. They have become the heart of users’ homes, and the tools for differentiation of service providers.

All the above-mentioned factors make me believe that the Wi-Fi part (i.e. HGW) will be replaced more often than the ONT part. For operators adopting a single-box approach, the costs of box replacement (during a given period) may be much higher than the costs of replacement of only HGW in a dual-box setup – even if the latter occurs more frequently than the former. In addition, the replacement of HGW in a dual-box setup can be offloaded to end-users as a DIY.

Forward and beyond the known

The right set of underlying assumptions is key to seeing costs in an FTTH business case in the right way. It is crucial if one wants to have the right data for a high-quality decision. Having said that, we also need to bear in mind that the amalgamation process of the access networks is on its way: fibre-access networks are no longer used for broadband residential customers only, but for backhauling of mobile small cells and for connecting small-to-medium businesses as well, with these having a potential to be an additional source of revenues.

And lest we forget while thinking about traffic: Who can predict the future effect of lesser-known factors, such as the metaverse?

The last one is…

So, coming back to the ZX-Spectrum-vs-PC dilemma: Make sure that someday you do not figure out that you are the last one who hasn’t managed to jump on the train of new technology.

And that all the other “kids” have already taken advantage of new revenues – while you were focused on costs instead of growth.

Related articles

Kontron's Take on the UK&I Market

Learn more

Unlocking invaluable benefits for fibre rollouts with interoperability

Learn more

Maintaining CPE Sustainability Every Step of the Way

Learn more